PCM Strategy Dial 11-02-2020

PCM's Strategy Dial Explained - Using Absolute Bond

Michael J. Chapman, CFP®, CIO

PCM Strategy Dial Explained: (PCM Absolute Bond Composite)

PCM’s Absolute Bond strategy is composed with up to two ETF’s allocated at the beginning of each month. The strategy invests in a proprietary allocation of ETFs, quantitatively selected from a basket of 8 ETF’s. These eight ETF’s provide exposure to: short, intermediate and long term US and International sovereign and corporate Bonds. The basket also includes ETF’s which provide exposure to various credit qualities and include an inflation protection ETF. Most importantly the basket contains a non-leveraged inverse ETF in order to provide potential protection and positive returns when rates are rising. The two ETF’s selected are given an equal weight of 50% each. Since there is only one “inverse” ETF in the basket, and given that there are two positons allocated each month, the most “Opportunistic Inverse” the strategy can be is 50% inverse and 50% cash equivalent. The most “Opportunistic long” the strategy can be is 100% (two 50% positions in various bond ETF’s). The possible combination of holdings can be broken down below:

Historic Perspective:

The US and many world sovereign bond markets have been in a long term, 30 plus year, bull market. The PCM Absolute Bond composite has a 9 year GIP compliant track record, during which time there has not been many opportunities to demonstrate how well the inverse ETF may potentially protect and enhance the return of the portfolio.

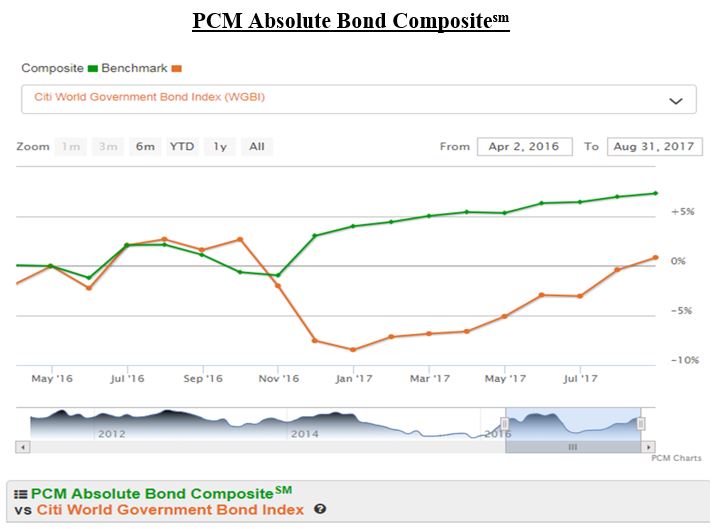

The bond markets did experience a sharp move up in rates (down in bonds) during the last quarter of 2016. Our PCM Absolute Bond strategy responded well, topping Informa’s performance list for both the fourth quarter of 2016 and for the entire year of 2016. The PCM Absolute Bond strategy moved to “Opportunistic Inverse” in November and December of 2016 resulting in a positive 5% return in our composite for the fourth quarter, versus an 8.5% decline in the Citi Corp Bond (Our benchmark). See chart below showing the monthly performance during the last quarter of 2016. Of course, past performance is no guarantee of future results. However, we believe that the performance of our Absolute Bond strategy during this period, illustrates the potential that our strategies can provide investors.

Superior full-market cycle returns are directly correlated to a reduction or elimination of large drawdowns in any given portfolio or investment strategy. To accomplish this an investment strategy must employ some form of risk management and should have the ability to capture positive returns in both rising and falling markets. Furthermore, it is important to have the ability to participate in all asset classes, all asset sizes and all asset styles across all markets to insure diversification that is truly non-correlated.

------------------------------------------------------------

Provident Capital Management, Inc. (PCM) is registered as an investment adviser with the State of Indiana, Securities Division. Registration does not constitute an endorsement of the firm by the State of Indiana nor does it indicate that the Adviser has attained a particular level of skill or ability. PCM claims compliance with the Global Investment Performance Standards (GIPS®). To receive a complete list and description of the firm's composites and/or a presentation that adheres to the GIPS® standards, please contact the firm at the address listed.